The long game: How to win Canada’s equity markets

Insights from Guardian Capital, the Canadian equity manager for the ONE portfolio

While 2020 was a year like no other, in many ways it was textbook when it comes to markets. It showed once again that regardless of market ups and downs, sticking to a clear, long-term investment strategy is the best bet.

Market highs and lows in 2020 were more extreme than usual, with the S&P/TSX plummeting 37% from their February peak, only to rebound 59% by year’s end. Through it all, Guardian Capital, which manages the ONE Canadian Equity Portfolio, navigated the markets to serve ONE’s municipal investors.

With interest rates at historic lows, equities play a critical role in any investment plan. ONE’s Canadian Equity Portfolio aims to provide long-term investment returns through a diverse and conservatively managed portfolio of Canadian equities.

“Guardian Capital invests in solid companies for the long term,” said Brian Holland, Senior Vice President, Guardian Capital LP. “These are secure investments that have provided long-term growth to the assets of municipalities across Ontario. They are overseen by a team of portfolio managers and analysts who scrutinize holdings and look for opportunities to build a strong and diverse portfolio.”

The strategy throughout the COVID market correction was to both take advantage of the sudden drop in market prices and to prepare for the economic recovery that would inevitably follow. Guardian added several new holdings in auto parts, auto repair and food to improve positions in financially strong companies that could weather the pandemic and benefit from the recovery.

The market volatility experienced in February to March 2020 can make some nervous about equity markets. But it needs to be put in context.

“What is less well appreciated is the consistency of results when viewed over the long term,” Holland said. “Equities markets provide positive returns, especially when you are in the market for a decade or more.”

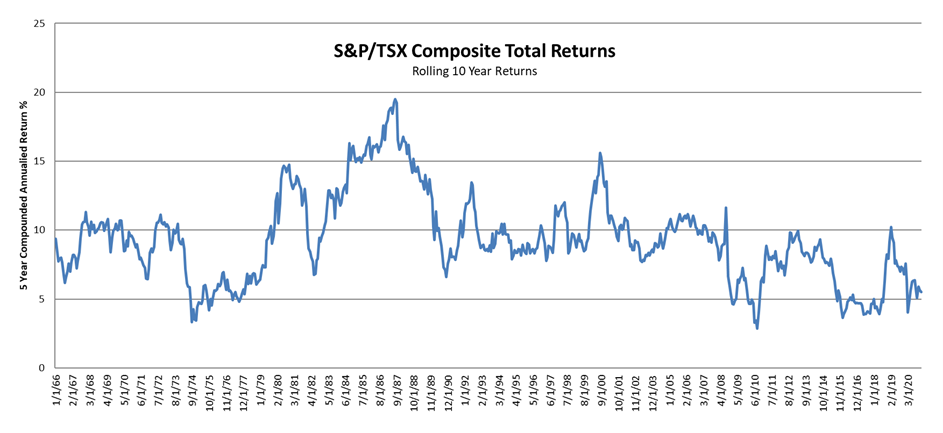

The graph below shows 10-year moving returns of the S&P/TSX Composite Total Return Index

from January 1956 to end of January 2021 (dividends reinvested and ignoring fees). Based on this Index data, over this period, there has never been a period where an investor has lost money over any 10-year period.

Looking ahead to 2021, lingering virus concerns will be pitted against the likelihood of re-opening as the vaccine rolls out. Economies have learned to cope with the virus to a greater degree than expected as people and businesses have continued to adapt. This has resulted in continued economic momentum despite the continued case counts. This economic headway has not come without volatility or reversals.

“As the recovery progresses, some shortages or price increases for goods such as steel, copper, and oil, could create some inflationary pressure. We are seeing this already in lumber markets,” Holland said. “While Guardian won’t make predictions, our portfolio managers and analysts are prepared to respond proactively to changing conditions, continually looking for opportunities that will stand the test of time.”